Know Your Numbers:

The 6 Essential Financial Terms Every Business Owner Should Understand

Managing your finances is more than just tracking expenses — it’s about understanding the numbers that tell the story of your business. These six basic financial terms will give you a clear picture of how your business is doing, where you stand, and what actions to take next.

No finance background needed — just simple explanations that make sense.

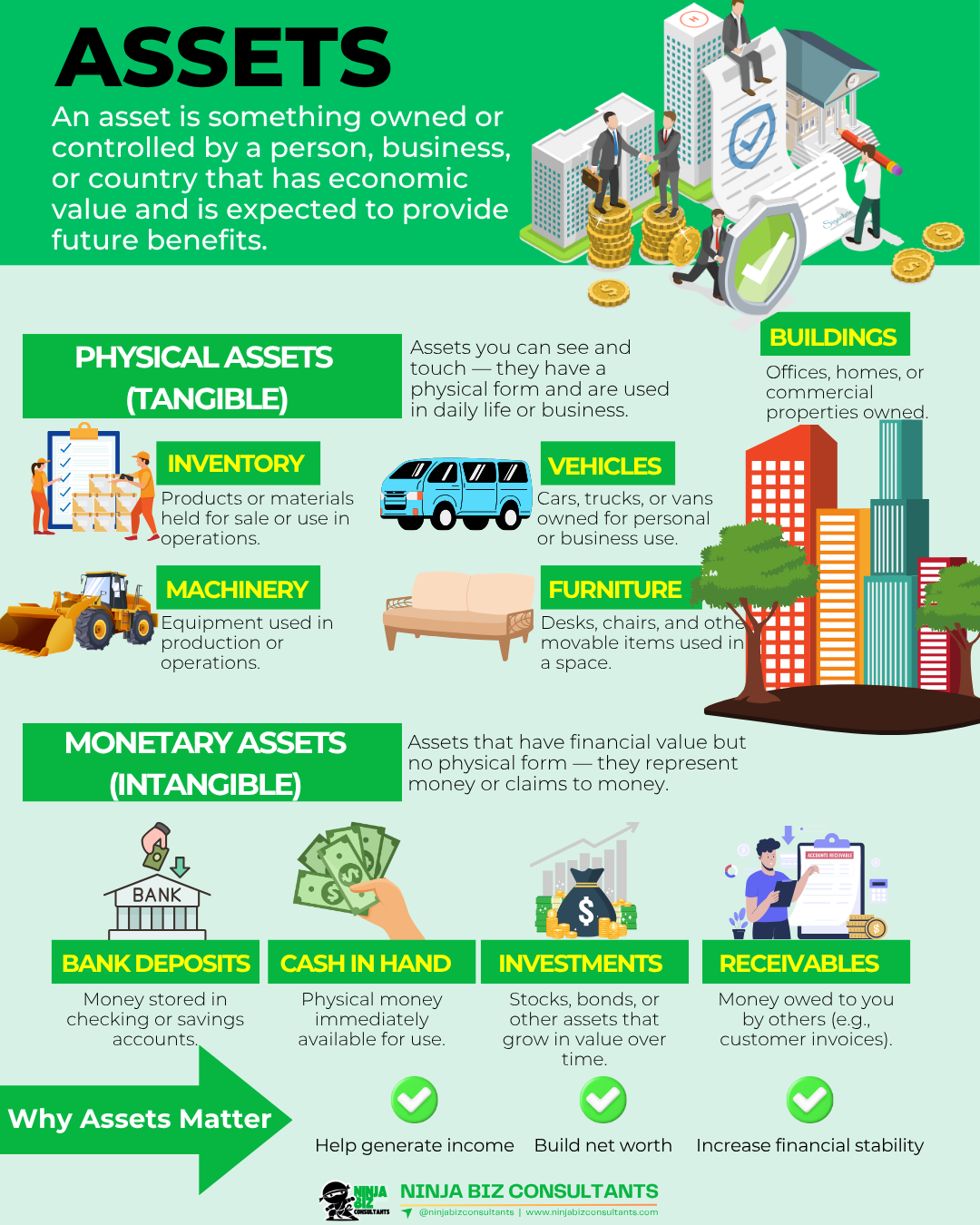

ASSETS

What Your Business Owns

What it means:

Assets are anything of value that your business owns. These are the resources you use to operate and grow.

Examples:

Cash and bank accounts

Equipment (like laptops, tools, printers)

Property or land

Money owed to you by clients (receivables)

Why it matters:

Your assets show the value your business is holding and can help when applying for loans or planning for growth.

Keep a list of your major assets and update it yearly — especially for things that depreciate like equipment and vehicles.

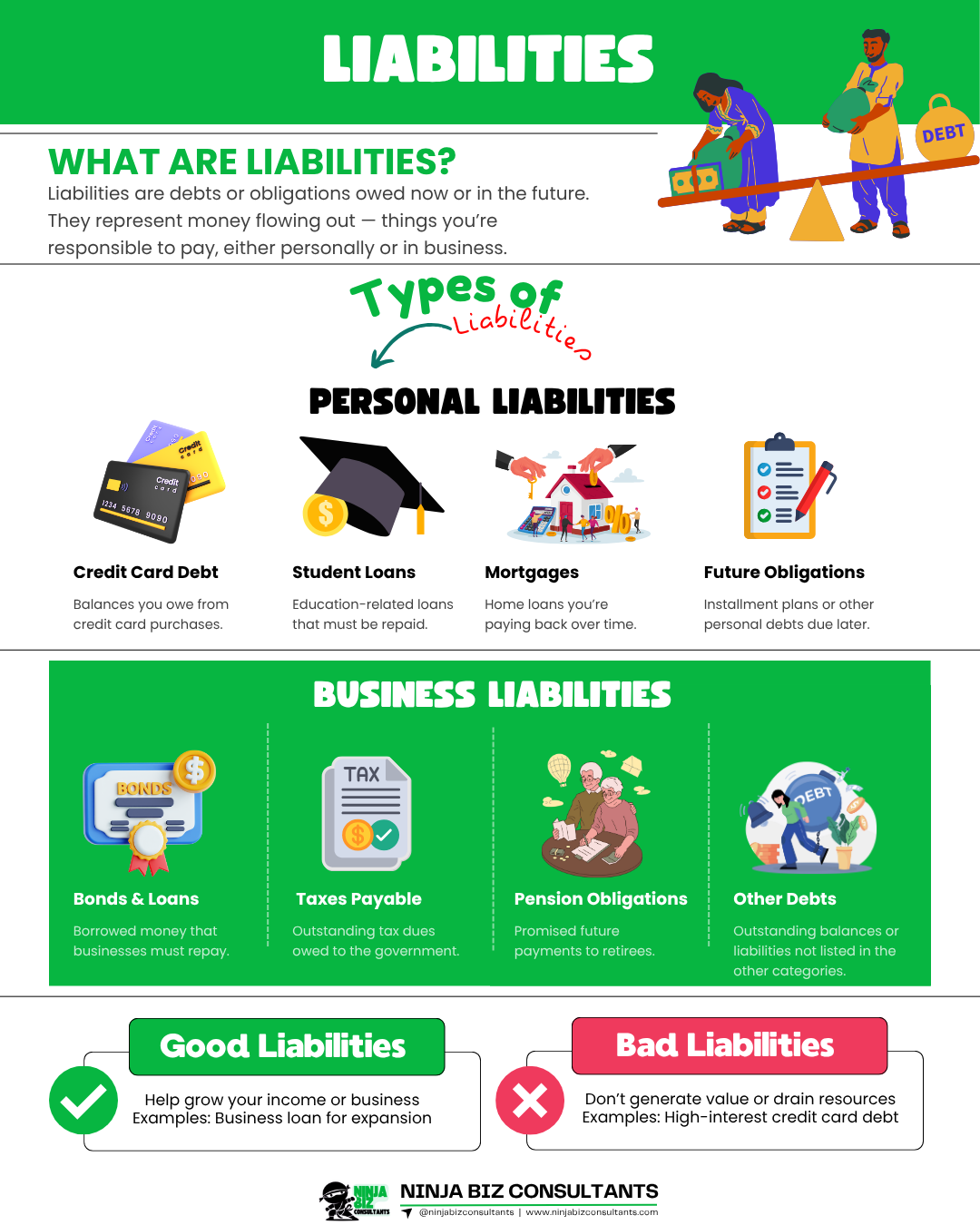

LIABILITIES

What Your Business Owes

What it means:

Liabilities are your debts and obligations. These are amounts you owe to others — now or in the future.

Examples:

Business loans or credit cards

Unpaid bills to vendors or suppliers

Taxes owed

Rent or lease payments

Why it matters:

Too many liabilities can put your business at risk. Managing them wisely helps protect your cash flow and credit.

💡 Tip:

Organize your liabilities into short-term (due within a year) and long-term (due later). This helps with planning.

NET WORTH

Your Business’s True Value

What it means:

Your net worth is the difference between what you own and what you owe.

Formula:

Assets – Liabilities = Net Worth

Example:

If your assets are $665,000 and your liabilities are $325,000, your net worth is $340,000.

Why it matters:

A positive net worth means your business is building value. A negative one is a sign to reassess or make changes.

💡 Tip:

Check your net worth every quarter. It’s like your financial report card.

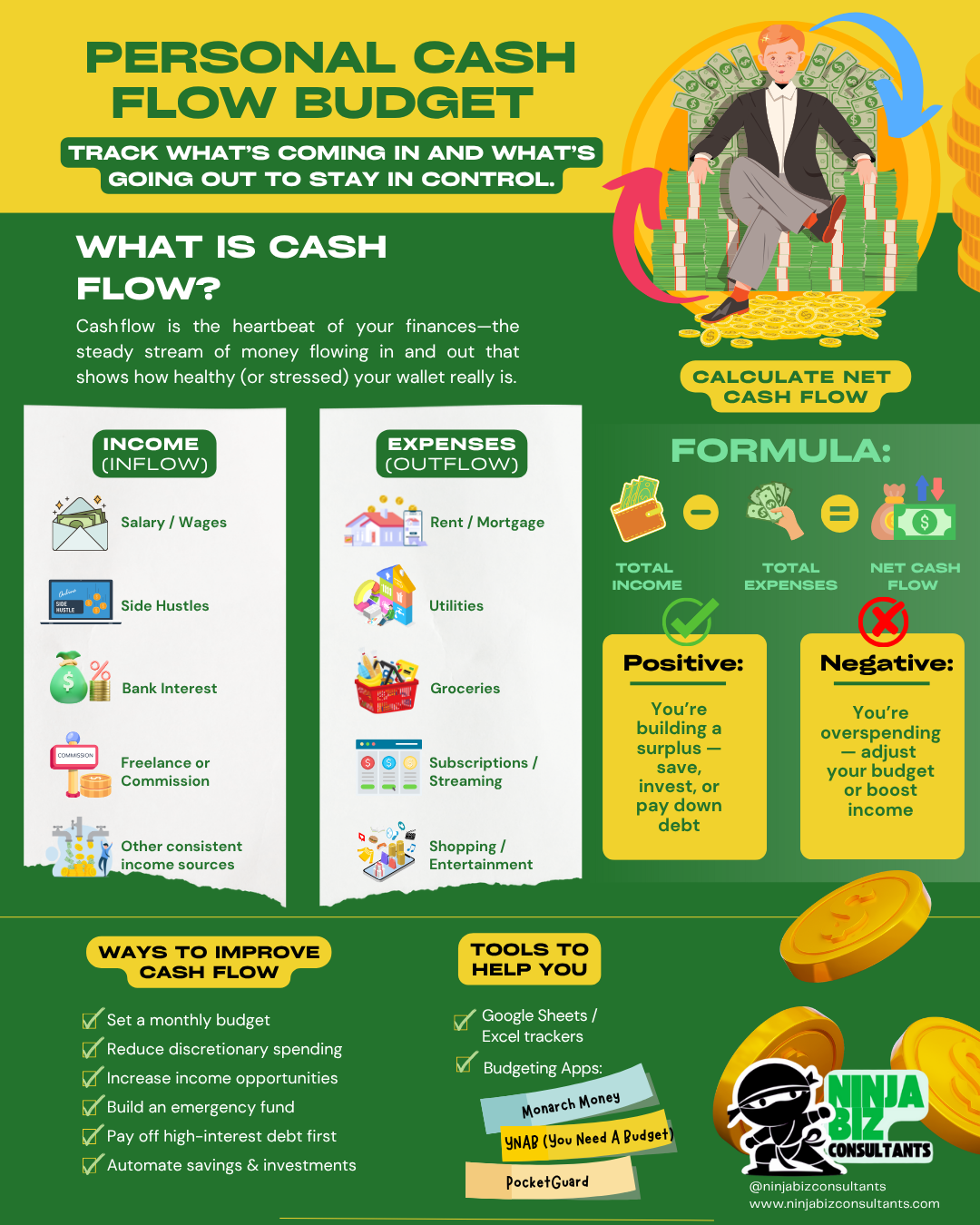

CASH FLOW

Money In vs. Money Out

What it means:

Cash flow tracks the money coming in (sales, income) and going out (expenses, bills). It’s not just about profits — it’s about having cash when you need it.

Examples of inflow:

Sales

Client payments

Examples of outflow:

Rent, supplies, software subscriptions

Loan payments

Why it matters:

You could be profitable on paper but still run out of money to pay your bills — that’s why healthy cash flow is crucial.

💡 Tip:

Always know your monthly inflow and outflow.

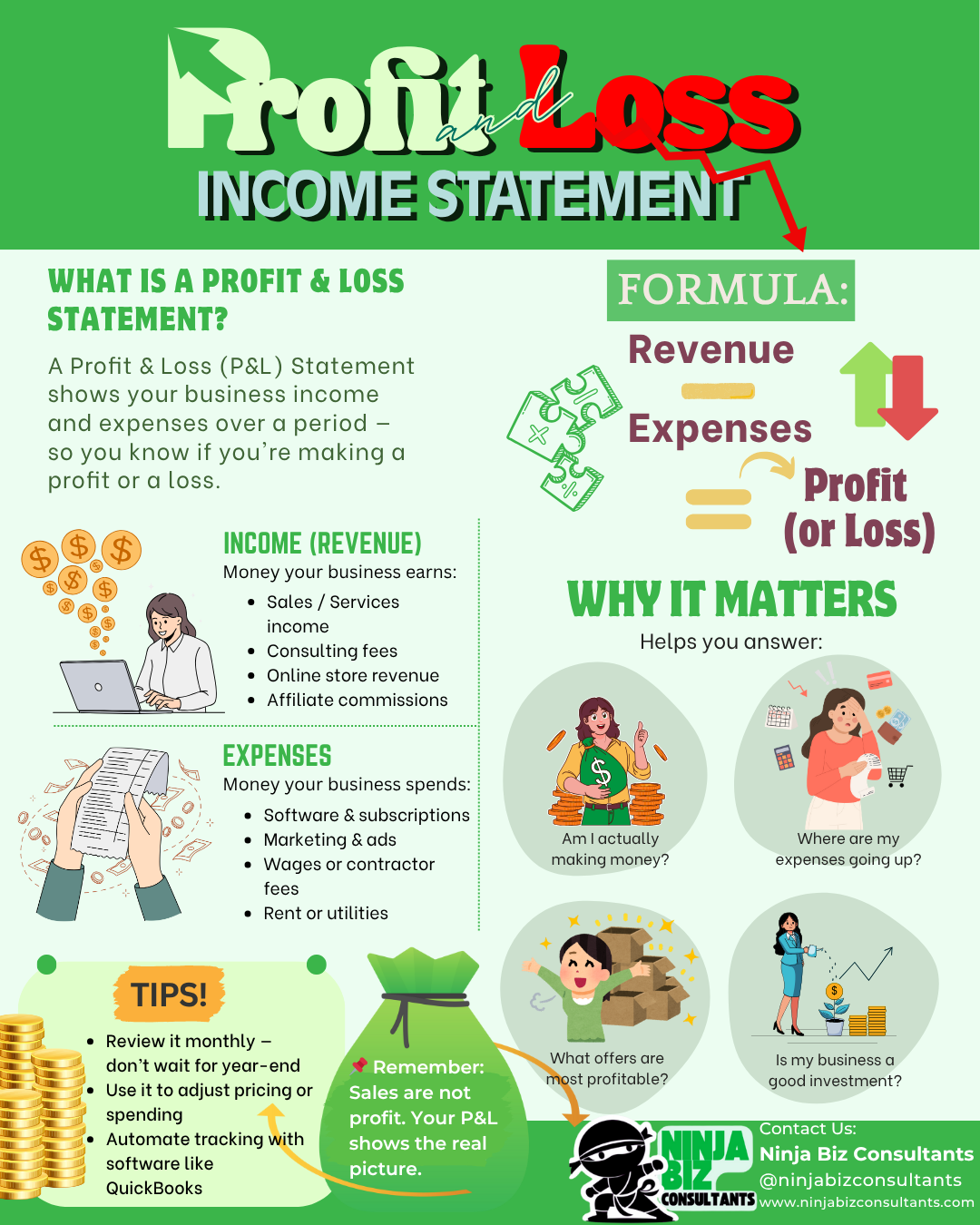

PROFIT & LOSS Statement (P&L)

Are You Making Money?

What it means:

This financial report shows your income and expenses over a period (usually monthly or quarterly), so you can see whether you’re profitable.

Basic formula:

Income – Expenses = Profit (or Loss)

Why it matters:

This tells you what’s working (and what’s not). You’ll use this report to make decisions, set goals, and prepare for taxes.

💡 Tip:

Review your P&L monthly to stay in control of your business direction.

BALANCE SHEET

A Snapshot of Financial Health

What it means:

A balance sheet shows your assets, liabilities, and net worth at one specific point in time.

Formula:

Assets = Liabilities + Equity

Why it matters:

This report helps you see your big-picture financial standing. It’s what lenders or investors use to assess your business stability.

💡 Tip:

Review your balance sheet at least quarterly to track your financial progress.

📍Follow us on Pinterest for bite-sized bookkeeping visuals and smart money tips you can save for later!